Purchasing Power is introducing an expanded set of “ancillary” financial wellness services that address the fundamental needs of employees who are often underserved by other financial benefits in today’s workplace. These services are designed to help our customers pave the way to financial empowerment with free access to financial wellness tools and services, credit-building tips, and budgeting advice.

These expanded, new services complement the core Purchasing Power employee purchasing program by enabling access to highly actionable, timely financial wellness benefits. These are made possible by strategic partnership with social impact fintech company SpringFour, a Certified B-Corporation.

The Purchasing Power Difference

By giving people a way to pay for important and emergency purchases over time, we reduce financial stress and improve the quality of life for our customers. These enhanced Financial Wellness Services provide employees the resources, knowledge, and action plans they need – regardless of where they are on their financial journey. We believe that people should have reliable and fair financing choices that serve to keep them on the path to financial health.

Purchasing Power’s suite of services focuses on a consumer’s financial journey, which could include:

- Connecting employees to the locally sourced Financial Health Resources they need

- One-on-one support to help build or rebuild an employee’s credit

SpringFour* connects you to over 20,000 local non-profit and government financial resources, making it easy to find financial help.

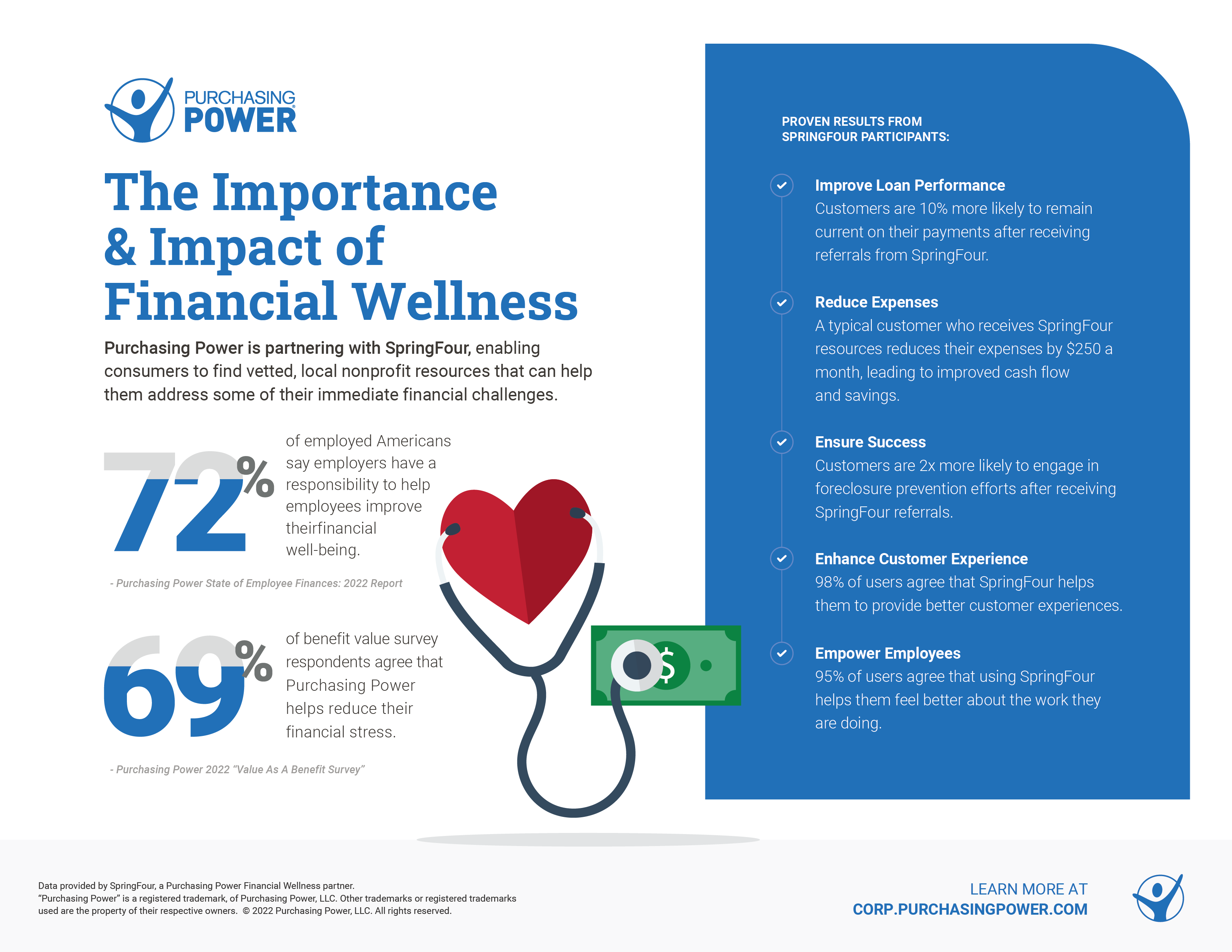

Financial Wellness Infographic

Click on the Financial Wellness Infographic below to view it in full size and/or to download it.

Why Financial Wellness?

The facts and numbers speak for themselves. Following are 5 Key Takeaways from our 2022 Harris Poll Among Full-time Employees conducted on behalf of Purchasing Power

- Just over half (54%) of full-time employees were either unable to cover monthly living expenses or lived paycheck to paycheck, barely covering monthly living expenses over the past year.

- Two in three (69%) of full-time employees were either more financially stressed or had the same amount of stress in January 2022 than they did in January 2021.

- Nearly one-third (30%) have less money or nothing in their emergency fund due to withdrawals during the pandemic.

- Almost one-third (29%) of employees took a job at a new company/organization in 2021. Four in five (80%) say benefits that their employer offers impact their decision to stay at their current job.

- Almost three-fourths (72%) believe that employers have a responsibility to help employees with their financial well-being.

Business Impact

Nearly all (97%) of full-time employees reported that they have financial stress and 87% said it affects them in some way.

- 34% say it affects their physical health

- 28% say it affects their ability to focus at work

- 25% say it affects their job satisfaction

- 21% say it affects their productivity at work

- 33% say they spend 1-3 hours per week worrying about/dealing with personal finances while working

Employee financial stress can impact the employers’ bottom line through increased healthcare coverage costs, loss of productivity and employee retention rates.

Financial Wellness FAQs

Learn more about how Purchasing Power's enhanced Financial Wellness Services will benefit our client's employees by visiting the Financial Wellness FAQs page.

*For participating employers only. The availability to each resource may vary. Login in to see your financial tools.

Contact Us Media Inquiries